Deductible Business Expenses 2024 – “IRS Provides Tax Inflation Adjustments for Tax Year 2024.” Internal Revenue Service. “Credits and Deductions for Individuals.” Internal Revenue Service. “Publication 535, Business Expenses . A business expense is any expense which is incurred while doing business. While most expenses are deductible, some expenses are only partially deductible. In addition, some expenses are not .

Deductible Business Expenses 2024

Source : www.fylehq.com

Compliance TV

Source : www.payroll.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Affable Tax & Accounting Experts | Facebook

Source : www.facebook.com

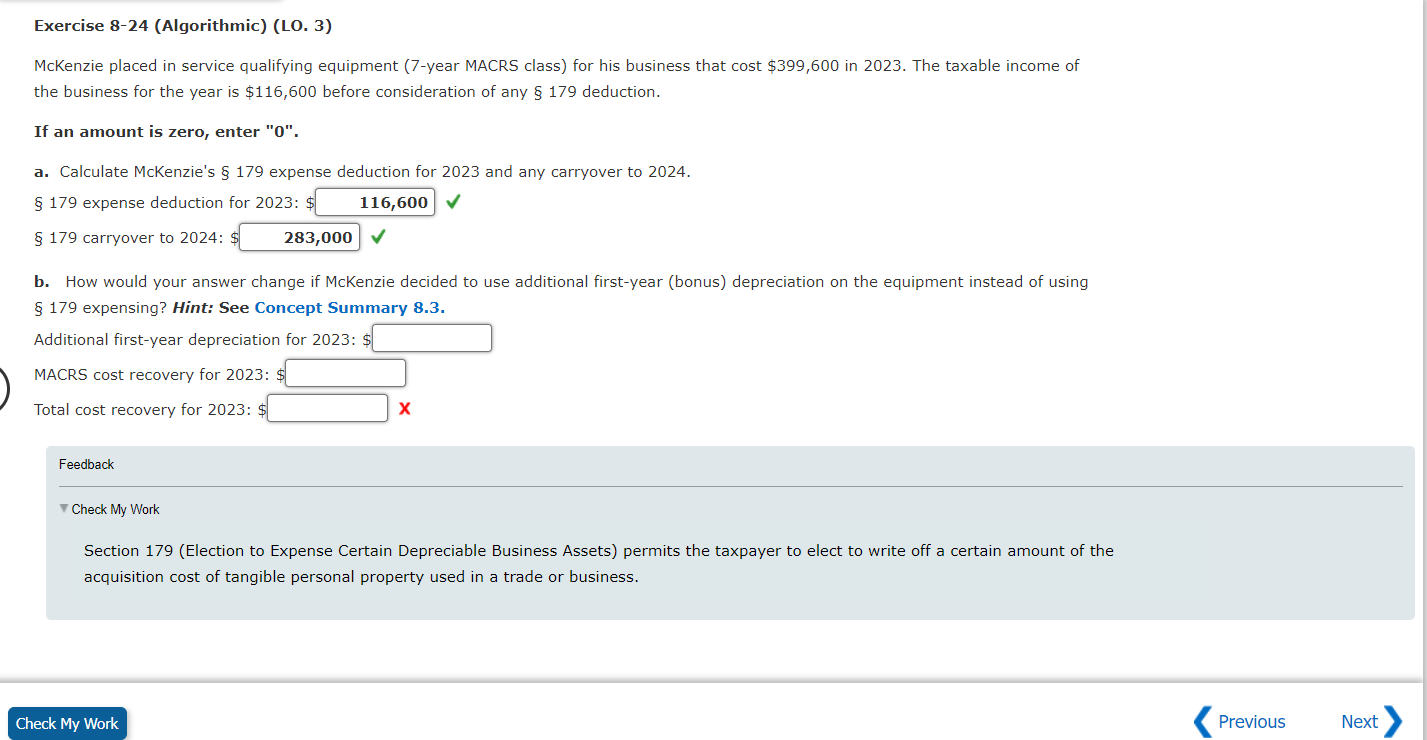

Solved Exercise 8 24 (Algorithmic) (LO. 3) McKenzie placed | Chegg.com

Source : www.chegg.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

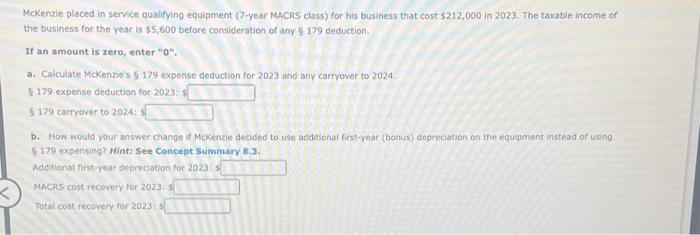

Solved McKenzie placed in service qualitying equipment | Chegg.com

Source : www.chegg.com

Wondering about deducting startup expenses for your new business

Source : www.instagram.com

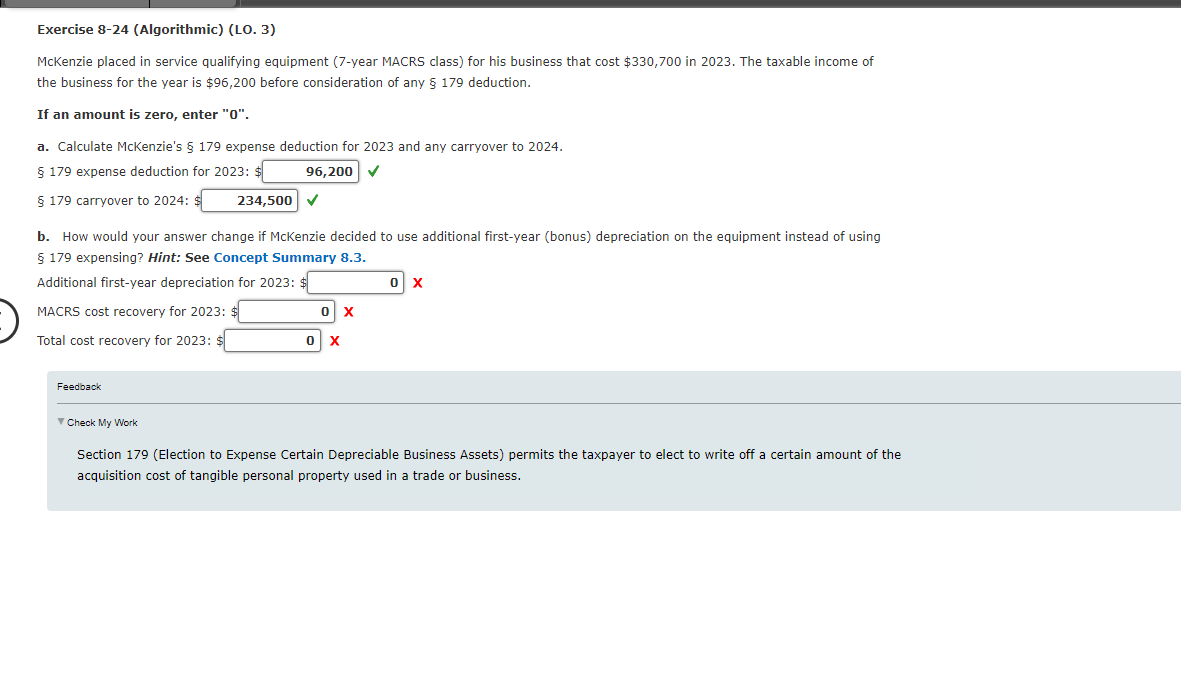

Solved Exercise 8 24 (Algorithmic) (LO. 3) McKenzie placed | Chegg.com

Source : www.chegg.com

2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.com

Deductible Business Expenses 2024 2024 Business Expense Categories Cheat Sheet: Top 15 Tax : Here’s what all investors may want to know about the new IRS tax brackets for the next tax year. See how it will affect you.More From InvestorPlace ChatGPT IPO Could Shock the World, Make This Move . Most business owners know that they can generally deduct operational costs such as rent, employee benefits and salaries. But what about other types of business expenses such as business insurance? If .